TAKE NOTE (Insights and Emerging Technology)

Though the data has yet to be released, Melanie Pustay, director of the Justice Department’s Office of Information Policy (OIP), expects 2018 was another record-breaking year for Freedom of Information Act requests. That means additional burdens on FOIA staff government wide, greater difficulty in reducing existing backlogs, and an interest in new ways of handling the increasing demand…

“I’m certainly expecting there to be even more FOIA requests for fiscal year [2018] than the year before,” Pustay said on Agency in Focus – Justice Department. “Certainly our trend line has been ever increasing numbers of requests; the public just seems like they can’t get enough of government information. And obviously it’s a great thing. On the one hand, we love to see people engage, but the challenge for agencies is keeping up with the demand.”

She said more personnel are always helpful, but the real innovation she sees comes from the IT side. Artificial intelligence is one new method to increase efficiency in processing FOIA requests in which Pustay sees particular promise. For example, discovery tools can be used to spot duplicate emails or run search terms faster and more effectively than humans could.

“I really think that the future of FOIA is now taking it to the next level and using artificial intelligence, and using software that can do things like group records together, either by concept or relationship, those kinds of software,” Pustay told Federal News Network’s Jared Serbu. “And those kinds of tools, I think, show real promise in the FOIA context by pre-processing records or grouping similar records together, which could then help speed up the actual review of the records for disclosability.”

She said OIP is at the very beginning of experimenting with these tools, and is still learning what they’re capable of. For example, she said they could potentially also be used to sort documents, flag or group records identified as deliberative by certain rules, or even help determine specific redactions or disclosures.

“It’s hard to think that we’ll ever get to a point where a machine, the software could literally process the document for release,” she said. “But if they can go part of the way there that will certainly make the process of the human review so much faster.”

Interested in learning more about RPA? Download our FREE White Paper on “Embracing the Future of Work”

UNDER DEVELOPMENT (Insights for Developers)

An Introduction to S/4HANA Finance

I wanted to write a few blogs on the S/4HANA subsystems, namely Simple Finance, Simple Logistics and IBP. The S/4HANA product is new in many ways. Extensive redesign of process streams, with input from customers and partners, has resulted in improvements in procurement, inventory management, material valuation, capacity planning, order management and more. Further, the creation of the universal journal and the central finance approach has increased the flexibility of the S/4HANA Finance subsystem. This has the possibility to deliver even more value to the enterprise as opposed to just accelerating the financial close process.

OK, lets start with Simple Finance, sometimes called sFin, now called S/4HANA Finance…

SAP S/4HANA Finance

SAP Simple Finance (sFin) is the financial and accounting component of SAP Business Suite for HANA (S/4HANA). SAP increasingly refers to S/4HANA Finance as the SAP S/4HANA Finance solution in anticipation of tighter packaging with the SAP Analytics Cloud. For clarity, I will refer to it as sFin or Simple Finance for this article.

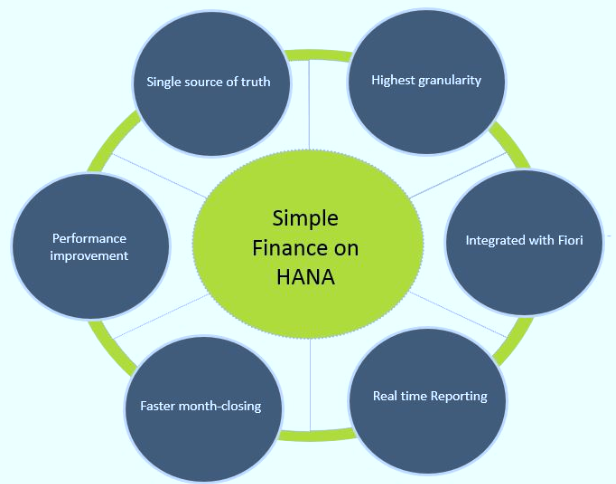

Simple Finance is an ERP financial software that runs on SAP HANA’s in-memory platform which allows users to run real-time reports on operational and financial data. Like other products on the HANA platform, the data is stored and processed in memory so you can analyze data quickly with few constraints. For example, you can run a soft close at any time of the day, month, or quarter with up-to-the-minute accuracy.

As part of the ERP package, financial data and operational data are pulled from one centralized location, which allows decision makers to examine problems from an organizational view rather than a limited department view. Simple Finance can be hosted in the cloud or on-premise, but SAP appears to be emphasizing S/4HANA Cloud. However, there are no indications that SAP intends to discontinue support customers who choose to host S/4HANA on premises.

In this post, I’ll examine sFin as part of the SAP S/4HANA Cloud 1902 release (February 2019). SAP announced that new financial planning and analysis capabilities will be released later this summer. The last part of this article will look at the financial capabilities SAP promises with this upcoming the SAP Analytics Cloud solution.

What has SAP S/4HANA Finance Simplified?

The “Simple” in Simple Finance refers to the what SAP refers to as a “single source of truth.” All data, both financial and operational, is accessible from one source which eliminates the need for data replications, reconciling data, and removing redundancies. Simple Finance calculates financial data in the HANA in-memory platform which allows you to run trail balance sheets, profit, and loss statements, and cash flow analysis reports using real-time data. There’s no need to wait for the end of the day, month, or quarter so you can instantly access your data for planning and decision-making.

The simplification between ECC and HANA with in-memory DB is that SAP has removed all the index and aggregate tables. SAP replaced these tables with ACDOCA-Single Source of Truth in the 1503 release (2014). This combined the FI/CO data from the distributed ERP with SAP or a third-party database. The next major release, S/4HANA, eliminated third-party databases so that all data is stored and processed in on the in-memory SAP HANA platform. The result is a single live data source with a high degree of granularity.

SAP Central Finance in 2 Minutes

Q&A (Post your questions and get the answers you need)

Q. What is the difference between a HARD CLOSE in my system and a SOFT CLOSE in SAP S/4HANA Finance?

A. Have you heard the term: Continuous Accounting?

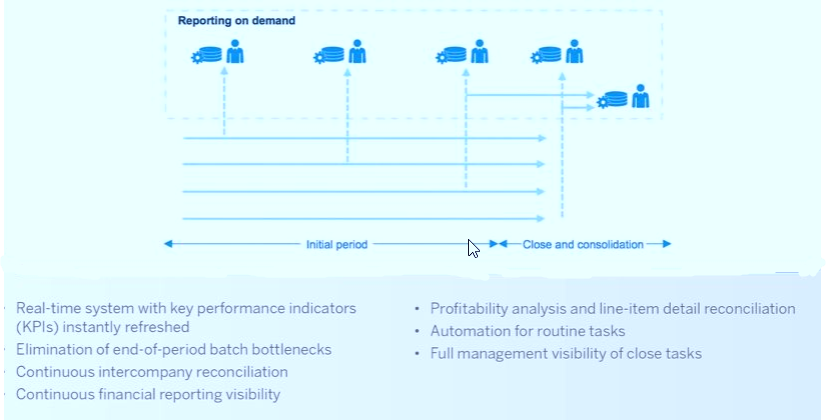

The concept of continuous accounting is that activities which were typically only executed at the end of a financial period can now be executed in real-time throughout a period. In this context, it is similar to the term “soft close.” Where “continuous accounting” is the execution of these activities in real-time throughout the financial period, the “the soft close” references the result: a company can see a financial snapshot of the company at any time throughout the period, simulating the financial results as if it were the actual period-end.

Let’s now look at the difference between a hard close and a soft close.

Hard close

Your company, especially if it is public, needs to generate and disclose financial statements by the deadlines set by regulatory agencies; especially global companies need to disclose to multiple tax jurisdictions. And many of these disclosures need to be filed electronically, to satisfy financial and tax reporting requirements. These financial statements are a snapshot of the financial state of the company at the end of a period, be it the end of the month, quarter, or fiscal year. These numbers do not change.

For years, companies have been working for years to accelerate their period-end close. While this is in part due to the need for external disclosures, including to shareholders, the other part of the equation is that the sooner the information about the financial state of the company is available, the sooner management decisions can be made about the company’s future direction.

Soft close

The idea behind the soft close is one of the outcomes of continuous accounting. With SAP S/4HANA Finance, there is no need to wait until the end of the period to run processes that have previously been run only at period-end because they required overnight batch jobs, such as intercompany and GR/IR reconciliations, and profitability analysis allocations and reporting. The end result is that finance is able to see a snapshot of the financial state of the company using trial balances and management reporting; these numbers are used for internal decision-making, and may change from day to day, depending on the transactions that flow into the system.

A soft close, which simulates the financial health of a company at any time throughout the period, allows a company to identify issues early and take immediate action, for example if there are delays in collecting on invoices from particular customers. The bigger impact, however, is being able to use the current information to use what-if analysis to provide strategic guidance to the company to make decisions, be it on a project level, or investments into new products and regions – all the way through to M&A decisions

Cheers!