Anthony Cecchini is the President and CTO of Information Technology Partners (ITP), an ERP technology consulting company headquartered now in Virginia, with offices in Vienna and Herndon. ITP offers comprehensive planning, resource allocation, implementation, upgrade, and training assistance to companies. Anthony has over 20 years of experience in SAP business process analysis and SAP systems integration. ITP is an Appian, Pegasystems, and UIPath Low-code and RPA Value Added Service Partner. You can reach him at [email protected].

Anthony Cecchini is the President and CTO of Information Technology Partners (ITP), an ERP technology consulting company headquartered now in Virginia, with offices in Vienna and Herndon. ITP offers comprehensive planning, resource allocation, implementation, upgrade, and training assistance to companies. Anthony has over 20 years of experience in SAP business process analysis and SAP systems integration. ITP is an Appian, Pegasystems, and UIPath Low-code and RPA Value Added Service Partner. You can reach him at [email protected].

You’ve probably heard that the blockchain is a technology that is going to change the world — it is the backbone of Bitcoin, the now infamous cryptocurrency. You might even have heard someone trying to explain blockchain by describing it as a “trusted distributed ledger.”

If you’re like most people, that’s when you stopped understanding — or even trying to understand — what this whole blockchain thing is all about. if you have 30 minutes, give this a read and I will do my best to explain it as I understand it and how Governments are using it today.

Blockchain was introduced to the world as the record-keeping mechanism for the cryptocurrency Bitcoin which was designed as an alternative to the global financial system and fiat money backed by central governments. Bitcoin wasn’t the first digital currency experiment, but it was the first to solve the problem of securing scarce digital assets. Blockchain is a database distributed over thousands of computers that maintains the list of transactions (called blocks) for each Bitcoin. This prevents users from spending the same Bitcoin multiple times. This established a sense of trust between buyers and sellers, often half a world away, without the need for a central broker.

In 2017, the G20 issued a statement encouraging countries to explore blockchain as an option for strengthening economic resilience and restoring faith in global trade. The statement recognized blockchain technologies as an opportunity to replace regulatory hurdles, but also notes that there are risks including tax evasion, money laundering, and terrorist funding. Blockchain’s ability to transparently record and verify transactions can improve government oversight. The statement includes a proposal for the “the establishment of a global regulatory sandbox for the most promising blockchain use cases” that would support startups and multicultural projects. The IMF, World Bank, OECD, and World Economic Forum are also looking the potential applications and risks of blockchain technologies.

Defining blockchain as a new type of database can be misleading. Blockchain extends the capabilities of a traditional database. The transactions in a conventional database often require a third-party to establish trust. For example, when you make a purchase with a credit card, the bank that supports that credit card verifies the transaction between you and the merchant. After this verification, the transaction between your credit card account and the merchant’s account is posted in the database. The bank charges a fee to act as the trusted third-party. Blockchain removes the need for a third-party to verify transactions by building security and trust in the architecture. Any changes or updates to the blockchain must be approved by consensus of all the participating parties on the network.

The database for blockchain is decentralized. Any user on the peer-to-peer, distributed network securely completes a transaction with another user without the need of a third-party. The blockchain ledger maintains all the information and cannot be altered after the transaction is complete. It is also transparent. Changing a transaction requires changing the entire database and will be visible to all users on the network. This transparency that allows you to see your transaction and anyone else’s transactions creates trust and keeps the system secure. The transactions are transparent, but the users can stay anonymous without paying a third-party. This combination of anonymity and savings is the main attraction to the businesses and governments.

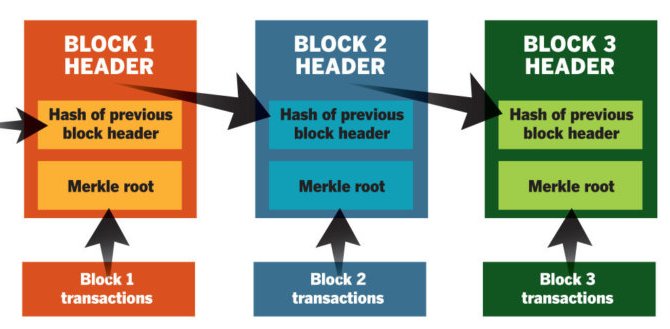

Blockchain architecture varies by project, but the architectures have similarities. Files containing all the transactions in each period are called blocks. Blocks are linked into chains. New blocks are created by mining. Each new block includes encrypted information from the previous block.

If someone alters a block, then it will break the chain. The blockchain is stored on several nodes (computers) by the block synchronization process. The network of nodes may be a few in a proprietary blockchain or several thousand in blockchains like Bitcoin or Ripple. Even if the block is altered on one computer, the original block is distributed over these nodes, and the change will be noted and corrected. This leads to the analogy of the distributed ledger where transactions are stored in multiple places rather than one central ledger.

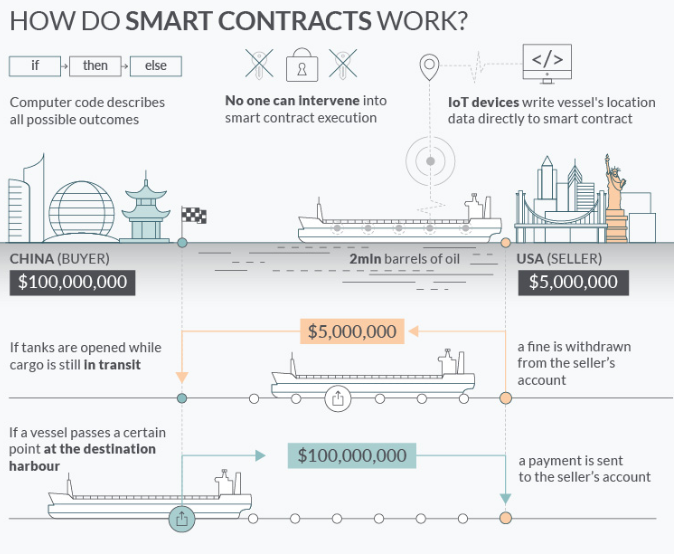

Smart contracts are programs that run on blockchain platforms. The program is created so that when Party A completes the requirements Party B set in the smart contract, then property is transferred from automatically. The Bitcoin blockchain supports blockchains, but the Ethereum blockchain was developed with smart contracts as a primary feature. There is active debate on which platform will become the standard. The Bitcoin blockchain is tightly coded, making security breaches more unlikely. The Ethereum blockchain is a more flexible platform with more features, but these additional options may open security or privacy weaknesses.

Governments view blockchain technology as both a threat and an opportunity. The US, China, Russia, and Korea started regulating initial coin offering (ICOs) and digital currency exchanges in 2017. Taxation is another concern. In the US, the IRS categorizes digital currencies like Bitcoin as securities. Bitcoin users are responsible for tracking gains and losses on each transaction based on the current trading price. The tax implications increase the expense of using cryptocurrencies as money.

In spite of concerns, government-sponsored blockchain projects are increasing throughout the world. China has moved to block non-government digital currencies but has invested in several government-sponsored blockchain projects. Russia has announced plans to issue its own blockchain-based fiat currency. Other countries including Gibraltar, Switzerland and Dubai are opening regulations in order to attract blockchain startups and ICOs. Aside from creating national cyber currencies, many of the projects are experimenting with blockchain solutions for administrative tasks like paying taxes or transferring property. Groups like the Chamber of Digital Commerce are advocating regulation and compliance changes to enable government entities to benefit from blockchain technologies.

More than 20 European countries have joined the European Blockchain Partnership to explore blockchain applications in a Digital Single Market. The Wanxiang Group plans to develop a smart city based on blockchain near Hangzhou, China. Blockchain will be used in all areas of government including smart cars, traffic control, identification systems, tax collection, and voting. In the US, the Chamber of Digital Commerce and 1776, a global technology incubator, founded the DC Blockchain Center in Washington DC. Their purpose to educate and collaborate with governments to find uses for blockchain. The DC Blockchain Center offers workspace and support to entrepreneurs and is planning a conference in March 2019 for government representatives, regulators, and policy makers.

Dubai launched the Global Blockchain Council in 2016. Membership includes government entities, financial institutions, and IBM. Soon after, Crown Prince H.H. Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum formally announced a blockchain strategy for Dubai that includes creating blockchain services throughout the city for administrative tasks. This includes document sharing, issuing business licenses, and automating new and renewed commercial licenses. Dubai has also started building a real-time customs and trading system built on blockchain, creating a digital passport system for Dubai International Airport, and establishing a blockchain-based storage system for medical records.

Sweden is currently developing a blockchain-based land registry that will allow real estate to be sold by smart contracts. The Lantmäteriet project requires synchronization of several EU property laws, so it requires a legislative solution in addition to the technological solution. Sweden is running a pilot based on ChromaWay’s blockchain technology. If successful, the smart contract system will replace Sweden’s existing paper-based process for transferring real estate.

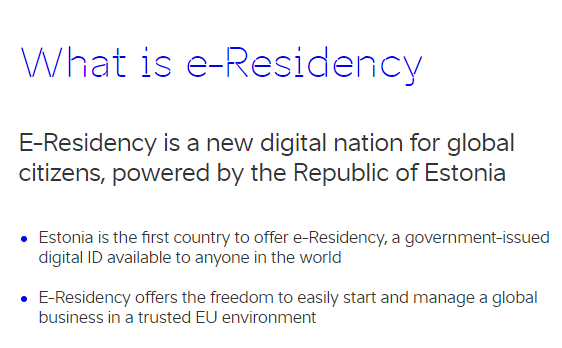

Estonia started applying blockchain technology to government administration projects including electronic voting systems and digital citizenship (e-Residency). The e-Residency programs allows non-Estonians not physically in Estonia to establish digital citizenship, start companies, and conduct financial transactions in Estonia. You can see the e-Residency information and application in English here.

After the 6-8 week registration process that includes a background check, any e-resident can open a EU-based company with access to the EU Single Market. Most of the banking transactions and tax payments in Estonia are done electronically. Last year, Estonia announced an ICO of a national digital currency the Estcoin.

In an interview with Wired, Kersti Kaljulaid, president of Estonia, the e-resident program has recruited 35,000 new digital citizens since 2014. Kaljulaid credits much of the growth in the digital state to the trust created by the secure foundation of blockchain technologies. Estonia began testing blockchain projects for government services in 2008 before the launch of Bitcoin and began using KSI Blockchain by Guardtime for its national health registry in 2012. Now blockchain technologies are used in judicial, legislative, security, and commercial code systems.

In the US, federal agencies are looking at blockchain solutions for information sharing, financial management transparency, procurement processes, and government-issued credentials like social security cards, visas, and passports. The GSA Emerging Citizen Technology Office started the US Federal Blockchain program find ways for federal agencies and US businesses to explore blockchain solutions. You can join the email list or find more information on the GSA webpage.

The US Department of Homeland Security is exploring ways to improve identification verifications. The US Treasury Department is piloting a supply chain management project based on blockchain technologies. Arizona, Georgia, and Illinois are considering legislation to accept cryptocurrencies for tax payments. Delaware is storing National Archive Records on a blockchain platform.

Summary

For those of us who have been involved in software for a long time, it feels like the early days of the internet, web 2.0, or smartphones all over again. Thinking of where this new technology sits within history feels right: While prognosticators love to talk about crypto and blockchain as a bubble, it is likely just very early days. And while 1999 marked what seemed like a high point for the internet before a precipitous fall, it proved to only be the first stage of the internet’s ascendance. Yes, there were implosions, but there was also Amazon.

Maybe it best to think about blockchain like this… There will be huge failures and misspent money — and yes, scams (the Securities and Exchange Commission can hardly keep up with the number of fraudulent players out there), but a decade from now, when you look back, it’s more likely than not that blockchain will be embedded in our day-to-day lives in ways that, today, we can’t even imagine.