Anthony Cecchini is the President and CTO of Information Technology Partners (ITP), an ERP technology consulting company headquartered now in Virginia, with offices in Herndon. ITP offers comprehensive planning, resource allocation, implementation, upgrade, and training assistance to companies. Anthony has over 20 years of experience in SAP business process analysis and SAP systems integration. ITP is a Silver Partner with SAP, as well as an Appian, Pegasystems, and UIPath Low-code and RPA Value Added Service Partner. You can reach him at [email protected].

Anthony Cecchini is the President and CTO of Information Technology Partners (ITP), an ERP technology consulting company headquartered now in Virginia, with offices in Herndon. ITP offers comprehensive planning, resource allocation, implementation, upgrade, and training assistance to companies. Anthony has over 20 years of experience in SAP business process analysis and SAP systems integration. ITP is a Silver Partner with SAP, as well as an Appian, Pegasystems, and UIPath Low-code and RPA Value Added Service Partner. You can reach him at [email protected].

Even with the technological advancements that have made some business departments obsolete, one department remains essential across all industries; accounting. Mistakes in this department generally mean huge losses that can cripple even seemingly stable companies. The year or month-end closing process is among the most critical yet laborious processes of the accounting department. This process entails the collection, validation, and reconciliation of data from diverse sections of a company. The accountant will then make the necessary adjustments to the data to generate an accurate financial report.

You cannot do away with your closing activities, nor can you afford the mistakes associated with using outdated methods for closing procedures. Thankfully, there is now a solution in S/4HANA Finance from SAP that gives you more functionality for your closing activities in record speed.

The SAP S/4HANA Financial Closing cockpit (FCc) for on premise and SAP S/4HANA Advanced Financial Closing (AFC) in the SAP S/4HANA Cloud.

First, lets do a remedial on SAP S/4HANA Finance…

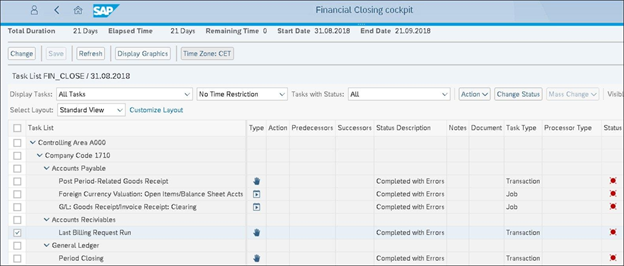

S/4HANA Finance a flagship financial solution from SAP released in 2014. The first release of S/4HANA Finance included the innovative Universal Journal that allows accountants to store their management and financial accounting documents in one place. The data in the Universal Journal includes that from the material ledger, asset accounting, profitability analysis, general ledger accounting, and management accounting platforms.

The use of the Universal Journal allows easy access to KPIs, improves financial reporting, and makes cockpits that are customized to end-users for informed decision making. Since 2014, SAP has continually improved the functionality of S/4HANA Finance. As of 2019, the solution included features like predictive accounting, accelerated financial closing capability, and centralized payables and receivables, among other embedded analytics.

T0 learn more about SAP S/4Hana Finance see our previous blog AN INTRODUCTION TO SAP S/4HANA FINANCE

SAP’s S/4HANA Finance truly revolutionized the handling of the closing process across all industries. The following are some of the activities that the solution can handle in your closing process:

Year and period-end financial accounting closing

Closing processes do not just take place at the end of a financial year. You also need to conduct pre-closing activities monthly to assess your business’s economic well being and make timely decisions. The data is also used to generate your annual financial report. S/4HANA Finance, in this case, handles the following period and year-end closing activities:

- Maintain the GR/IR {goods receipt and invoice receipt} clearing accounts.

- Post payrolls on the Human Capital Management {HCM} portal.

- Process purchase order accruals and recurring entries.

- Repost and handle allocations in management accounting.

- Post the good issues for deliveries in your supply department portal.

- Open a new financial accounting period in OB52.

Fixed and current assets’ closing

In the fixed and current asset’s closing for your closing activities, you can:

- Change the fiscal year for your asset accounting. The asset valuation from the preceding fiscal year will be automatically carried forward into your new fiscal year. You can then make postings of your assets into the new year while still posting in the old year.

- Execute your year-end closing program on the “schedule asset accounting jobs,” an SAP Fiori app. If the app finds no errors in your data, it will update your previous fiscal year’s depreciation area and lock the closed fiscal year postings from different asset areas.

- Maintain the GR/IR clearing account in MM if the material quantity received differs from the invoiced amount. The account is also analyzed to ensure a zero balance. This analysis is often done monthly.

- Conduct a stock valuation for supplies, raw materials, consumables, work in progress, and finished products.

Receivables and payables closing activities

With the S/4HANA Finance solution, you can handle the following closing activities for your account receivables and payables:

- Forward the balances in your customer and vendor accounts to a new fiscal year. With this, you can then generate balance confirmations.

- Create automatic customer balance slips and reply slips. You can also generate a results table and reconciliation list in the process.

- Forward the reconciliation list to a control center. The reply slips and balance confirmation can be sent to the vendors or customers. The reconciliation list and reply lists are also compared then the data entered into a result list.

Technical steps for closing activities

The balance carry forward program is one of the tasks executed at the start of your fiscal year. The technical steps involved in this program include:

- Carrying the balance of your asset, account receivables, account payables, and general ledger accounts to the following financial period.

- Opening the closing postings for special periods and closing the posting periods for an old fiscal year.

- Performing accruals.

- Valuating foreign currency documents.

- Analyzing GR/IR clearing accounts and regrouping their balances.

- Executing the balance audit trail.

- Creating a financial statement.

Monitoring activities

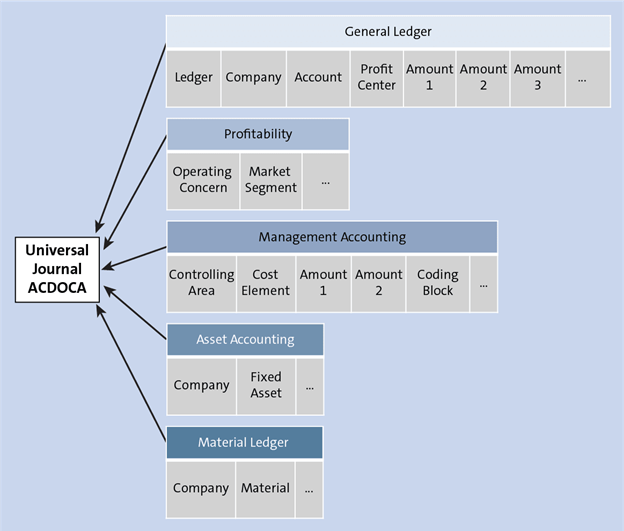

The S/4HANA Finance solution also has a monitoring tool called the Financial Closing Cockpit. It lists the steps that you should perform during the closing of a financial year, creates a schedule of these tasks then monitors the tasks’ execution. This was offered as an add-on in the past, but SAP has now integrated the Financial Closing Cockpit into the S/4HANA environment. The monitoring tool now sits just above the Universal Journal. It optimizes your closing through the following capabilities:

- An automatic standardized functionality to manage reconciliation and management activities.

- Scheduling tools that will monitor, control, and sequence your workflows for a smooth closing process.

- Maintenance of multiple factory calendars.

- Closing templates.

- Full monitoring of the closing processes and flexible notifications.

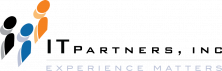

Here is an illustration of how the task lists in S/4HANA’s Financial Closing Cockpit work:

When you click the closing tasks tile, for example, you might see something like the following figure detailing the status of your tasks, any errors, attachments, and notes, among other information:

Accountants and finance officers are under constant pressure when a financial period ends to generate a detailed report that will guide decision making. The S/4HANA Finance solution from SAP offers the following benefits:

Streamlined reporting

The database table in SAP S/4HANA Finance will hold all the relevant financial information for closing and use its in-memory computing to generate detailed, real-time closing reports. This eliminates data replication and the need for batch tasks encountered when manually entering financial information or getting it from multiple sources.

Accelerated financial closing

Accounting departments can incur high losses from the hours most of the staff will dedicate to the compiling of closing reports at the end of every fiscal period. S/4HANA Finance changes a company’s process of generating annual, monthly, quarterly, and bi-annual closing reports. It provides an almost instant visibility of a business’s profits and losses along with real-time analysis of numbers. As such, the time taken to generate closing reports is significantly reduced.

Integrated business planning

With the automated uploading of most of your company’s financial information to the cloud, different decision-making players have easy and quick access to it. As such, you can plan the best way forward for your business with the latest well-laid out information to guide your decisions. S/4HANA Finance also makes real-time analysis of data from different departments a reality.

Easy asset accounting

You had to record the depreciation or appreciation areas of your assets over and over on different platforms in the past. This was not only exhausting and confusing, but it was also hard to keep track of the depreciation or appreciation of assets. The new asset functionality in S/4HANA Finance solution allows the parallel management and valuation of your assets via your company accounts or ledgers.

Improved cash management

There is a cash management feature included in the S/4HANA Finance solution to manage your short-term cash position and bank accounts. All these tasks are undertaken with the backing of real-time data. These tools are the perfect ones for fine-tuning your cash management while maximizing your working capital. There is also integrated liquidity planning in the S/4HANA Finance solution that pulls information from your purchase orders and internal sales. You can use this information to identify potential liquidity surpluses and deficits.

Optimized financial reporting

One of the critical features of S/4HANA Finance is the financial reports. These are amazingly fast and give a user access to an extensive suite of analytical tools. The financial reports feature replaces the traditionally error-filled financial statements and allows users to get in-depth analytics of their numbers to pick the KPIs that best reflect their financial well being.

Decreased finance department running costs

With most of the tasks in the finance department automated by the S/4HANA Finance solution, you can afford to reduce its staff numbers. This translates to low operation costs and an overall increased profit.

Summary

- The SAP S/4HANA Financial Closing cockpit is a comprehensive solution for managing your global financial close on the entity level.

- It covers the planning, execution, monitoring, and analysis of financial close tasks.

- It allows you to standardize your close process across entities and closing cycles, increase compliance, gain transparency, and drive efficiency through higher automation.

- External schedulers are an additional process automation component, tightly integrated into, and accessible via, the SAP S/4HANA Financial Closing cockpit.

- It supports you with SAP and non-SAP tasks, event-based scheduling, intelligent validation of task output, intelligent auto-reactions, batch input management, and more, to reduce manual effort.

- SAP S/4HANA Financial Closing cockpit and external schedulers (optional) are part of a full suite of comprehensive solutions for the end-to-end Financial Close, making it faster, more accurate, and less costly to execute.